To retrieve and see individual client details from myIR, agents will need to add a Taxpayer. This process will also need to be followed to use the tax calculator.

Step 1

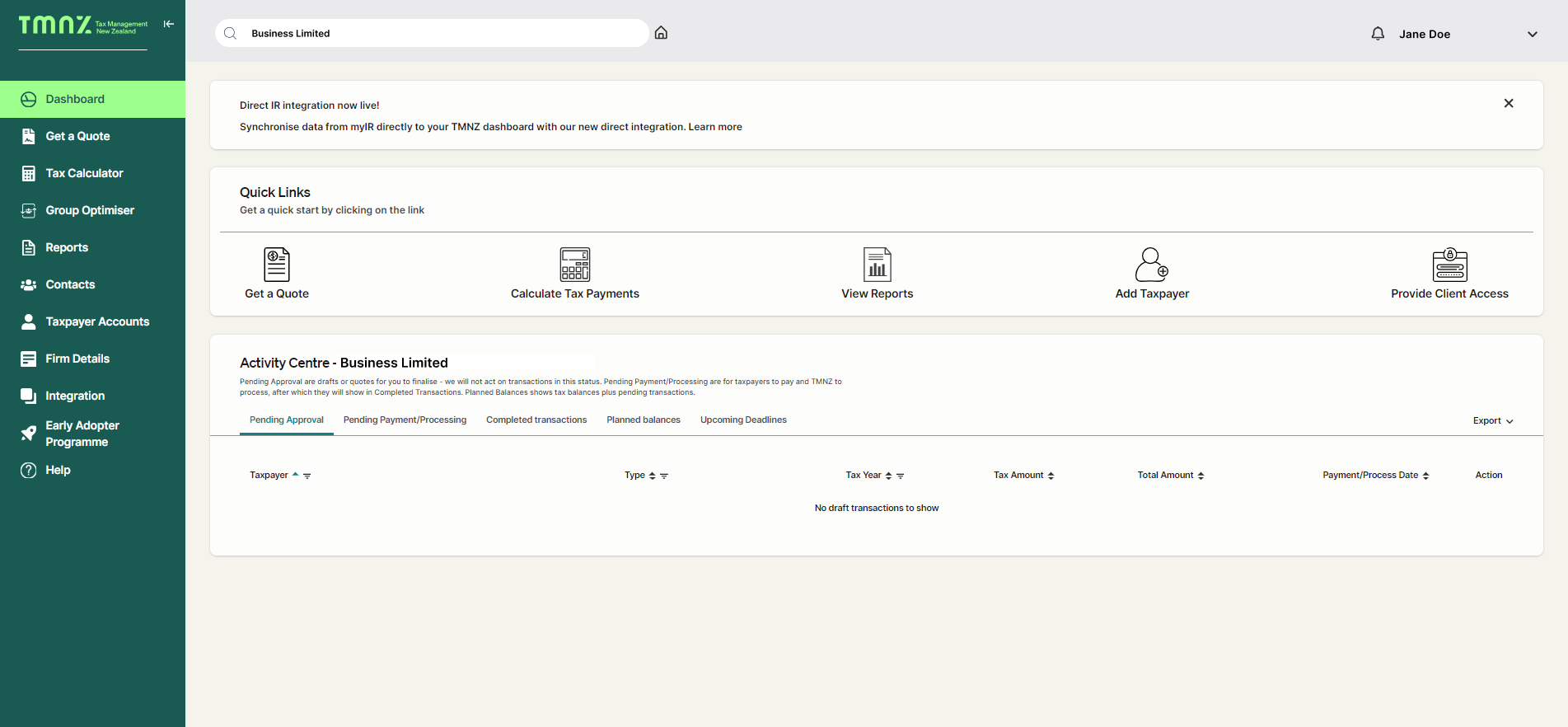

Log in to the dashboard

Under the Quicks Links section click Add Taxpayer.

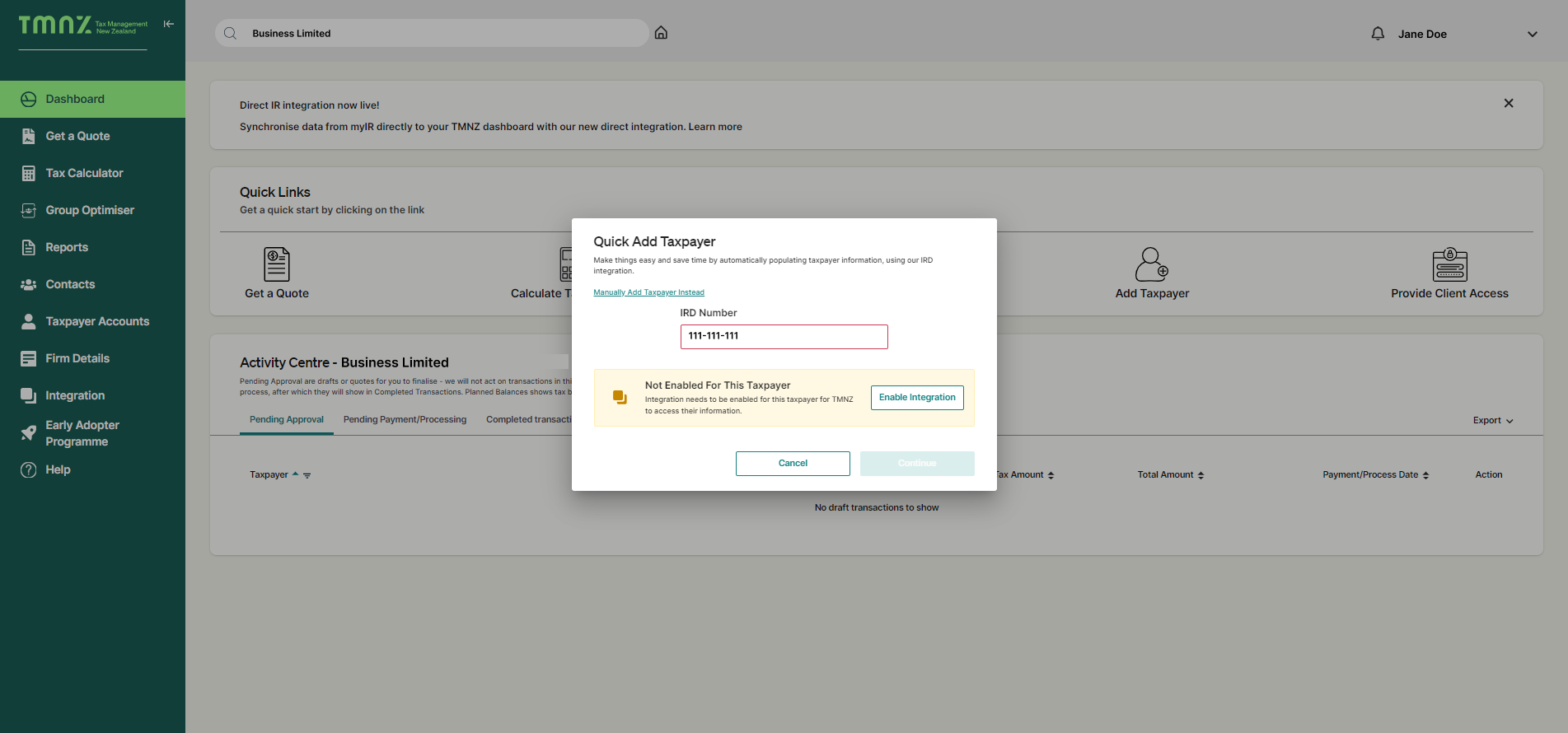

Enter the taxpayer’s IRD Number.

Note: If the IR Integration is not enabled for that Taxpayer, you will be prompted to click Enable Integration – as the Integration needs to be enabled for TMNZ to access their information. Follow the instructions here to enable this sync.

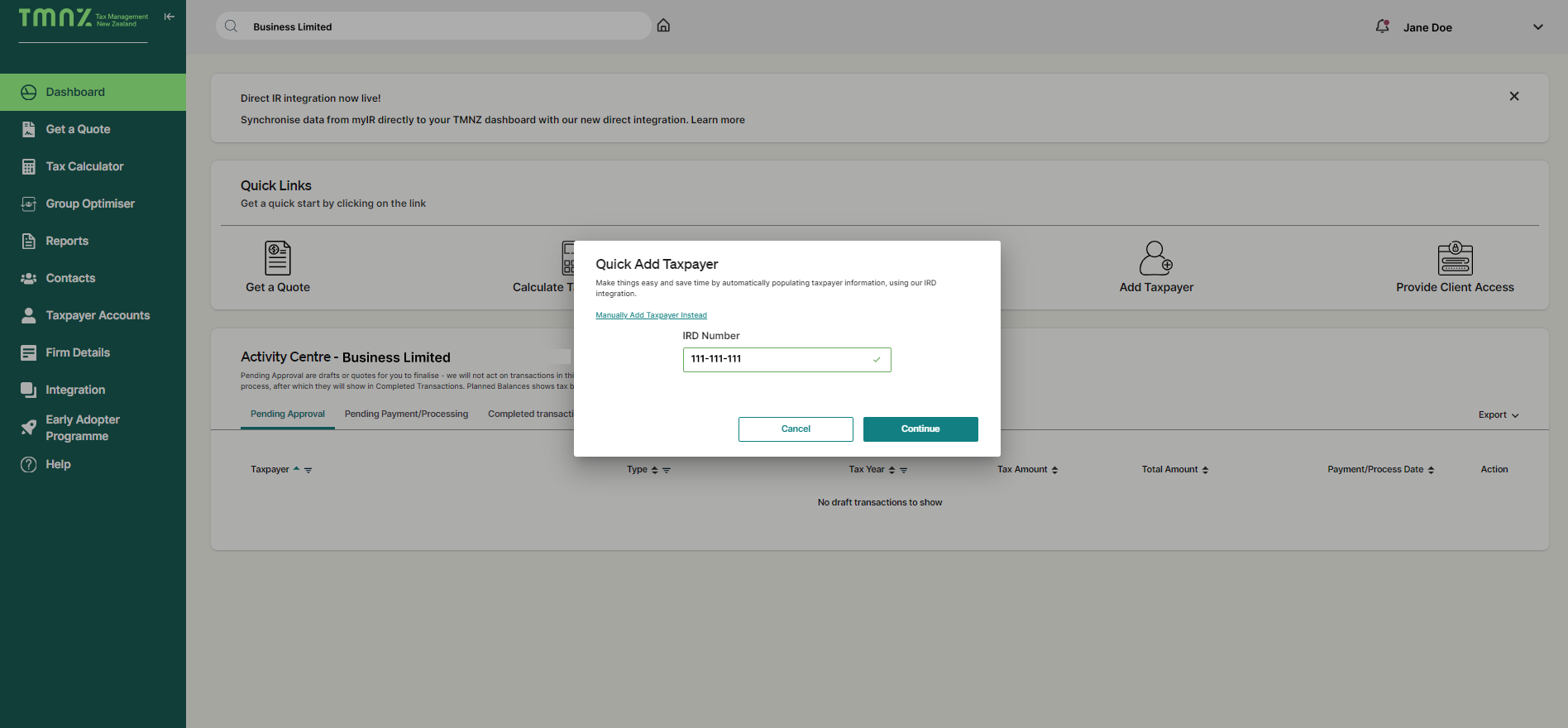

Once the Integration is enabled for that Taxpayer, repeat the above steps (Add Taxpayer and enter the taxpayer’s IRD Number).

Now a green tick will appear beside their IRD Number.

Click Continue.

Step 2

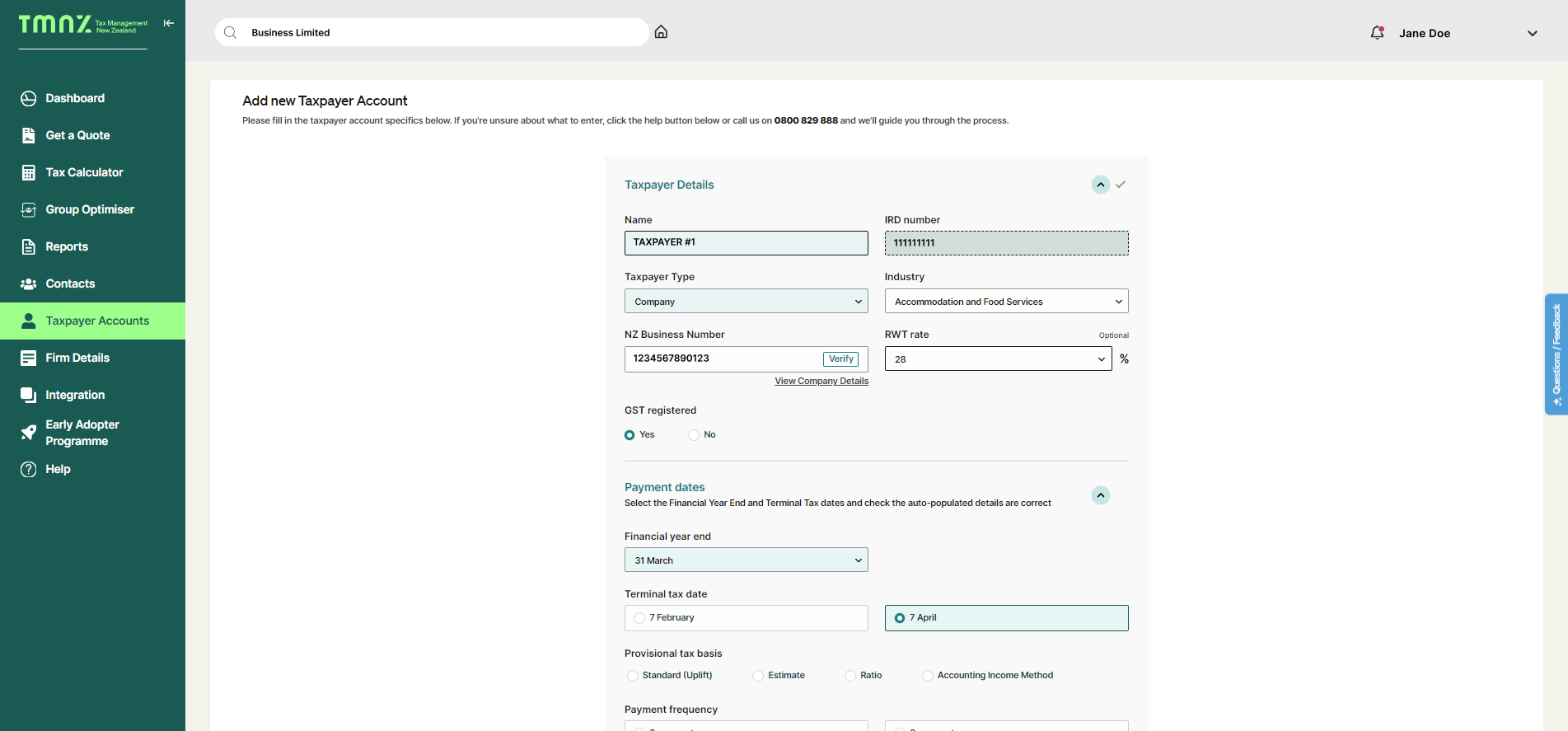

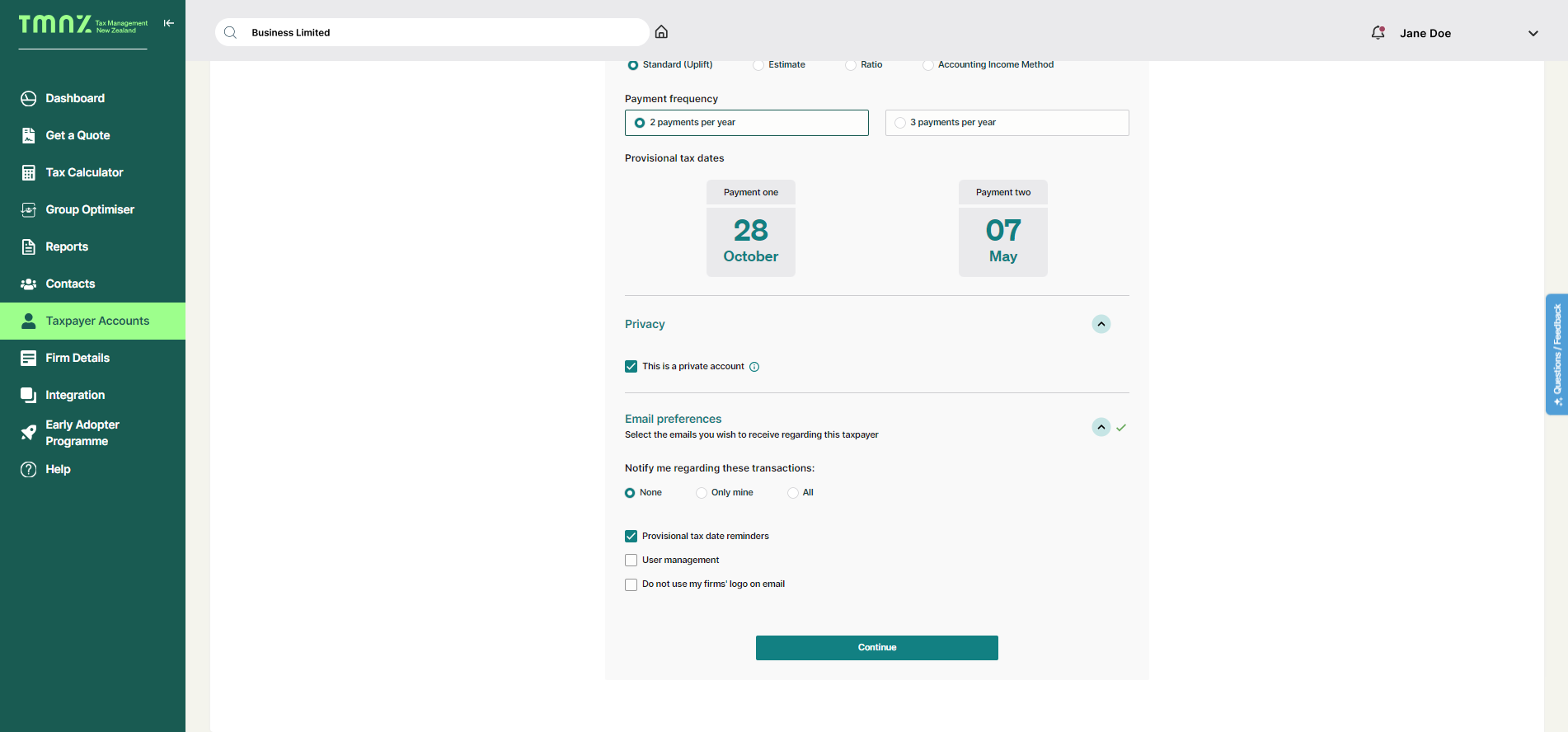

Review the taxpayer’s details

The Taxpayer’s account details will be pre-populated with information from IR. Review this information and add any relevant details that may be missing e.g. Industry, email preferences.

Click Continue.

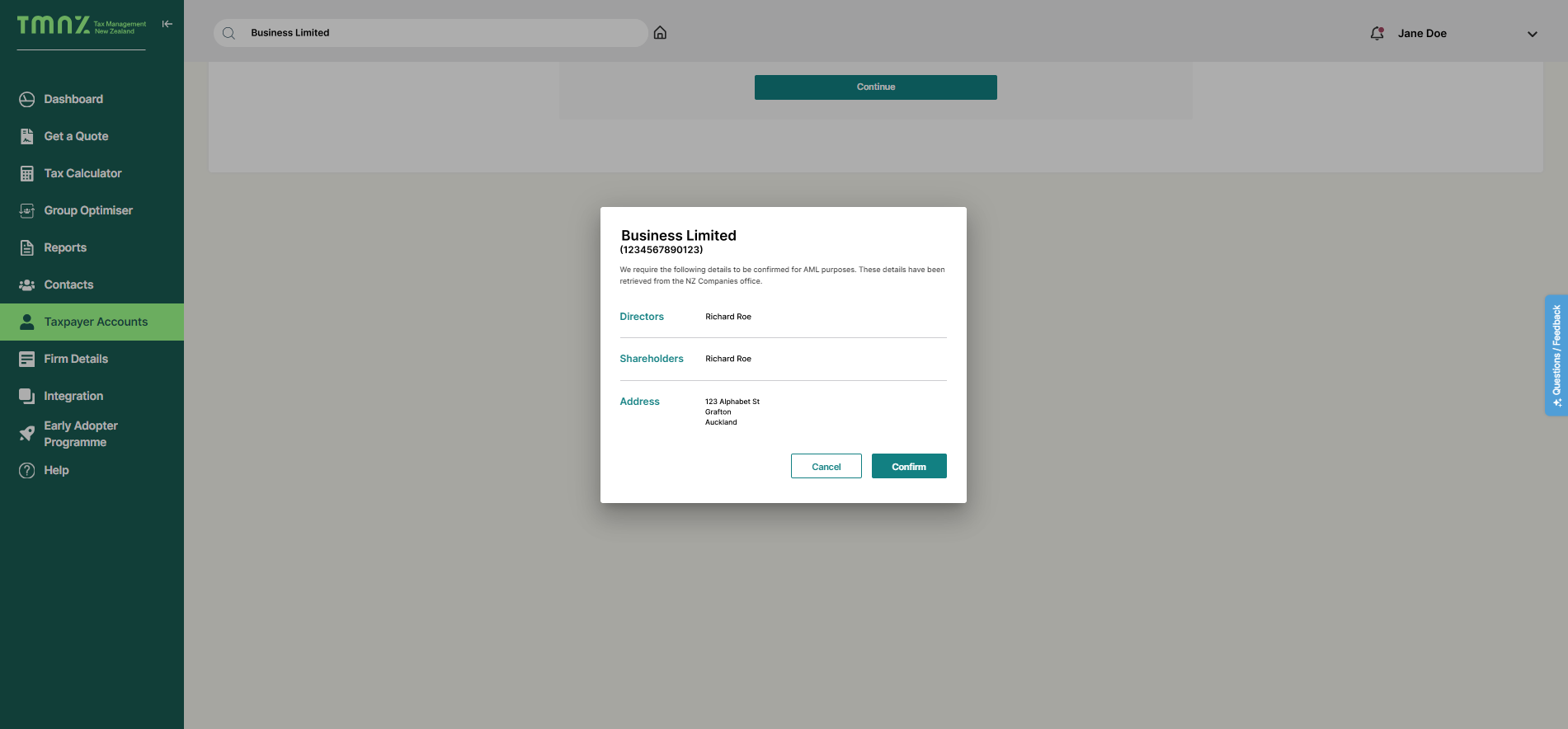

We require company details to be confirmed for AML purposes. These details will be retrieved from the NZ Companies office. Review the information and click Confirm if correct.

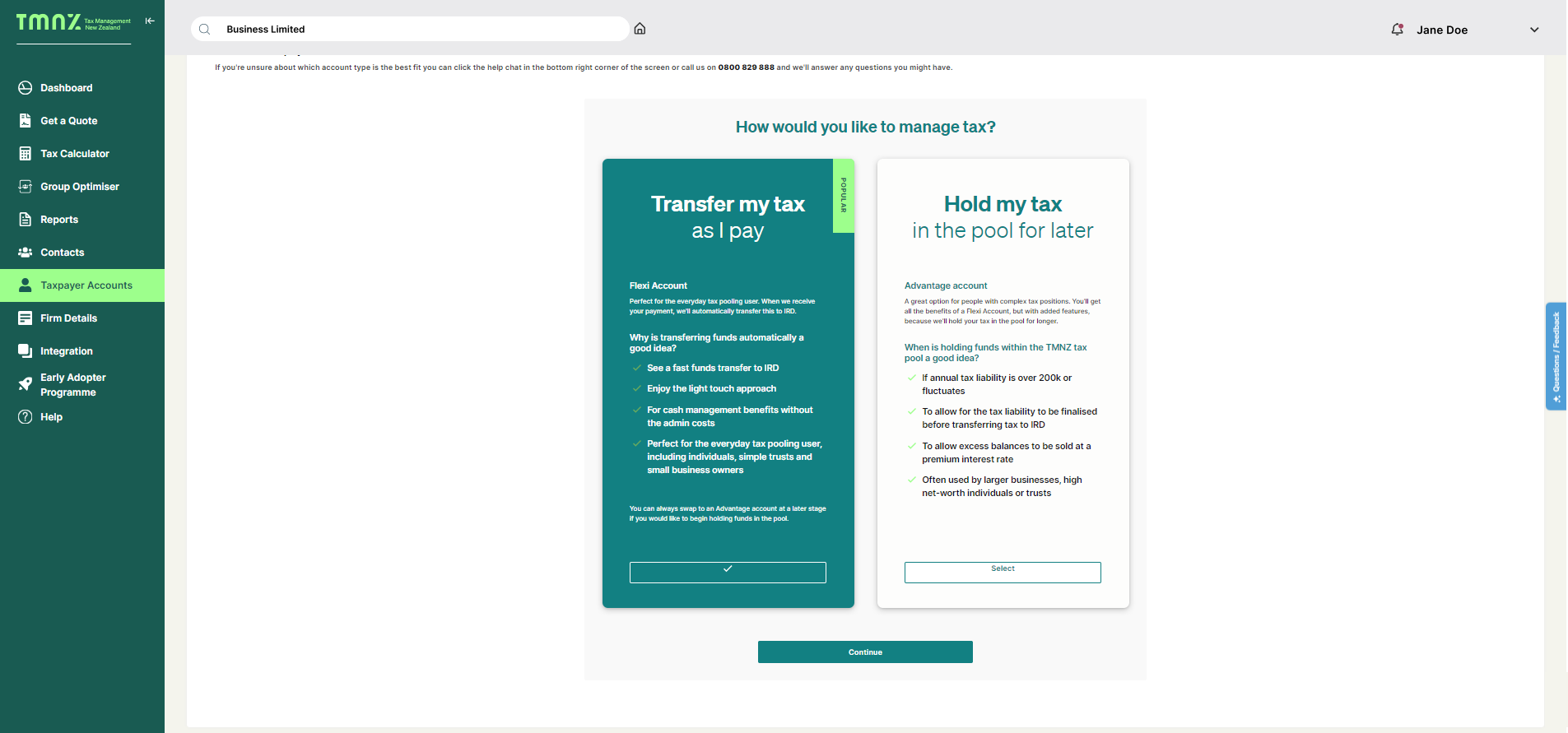

Choose option under ‘How would you like to manage tax?’ Click Continue to proceed with your selection.

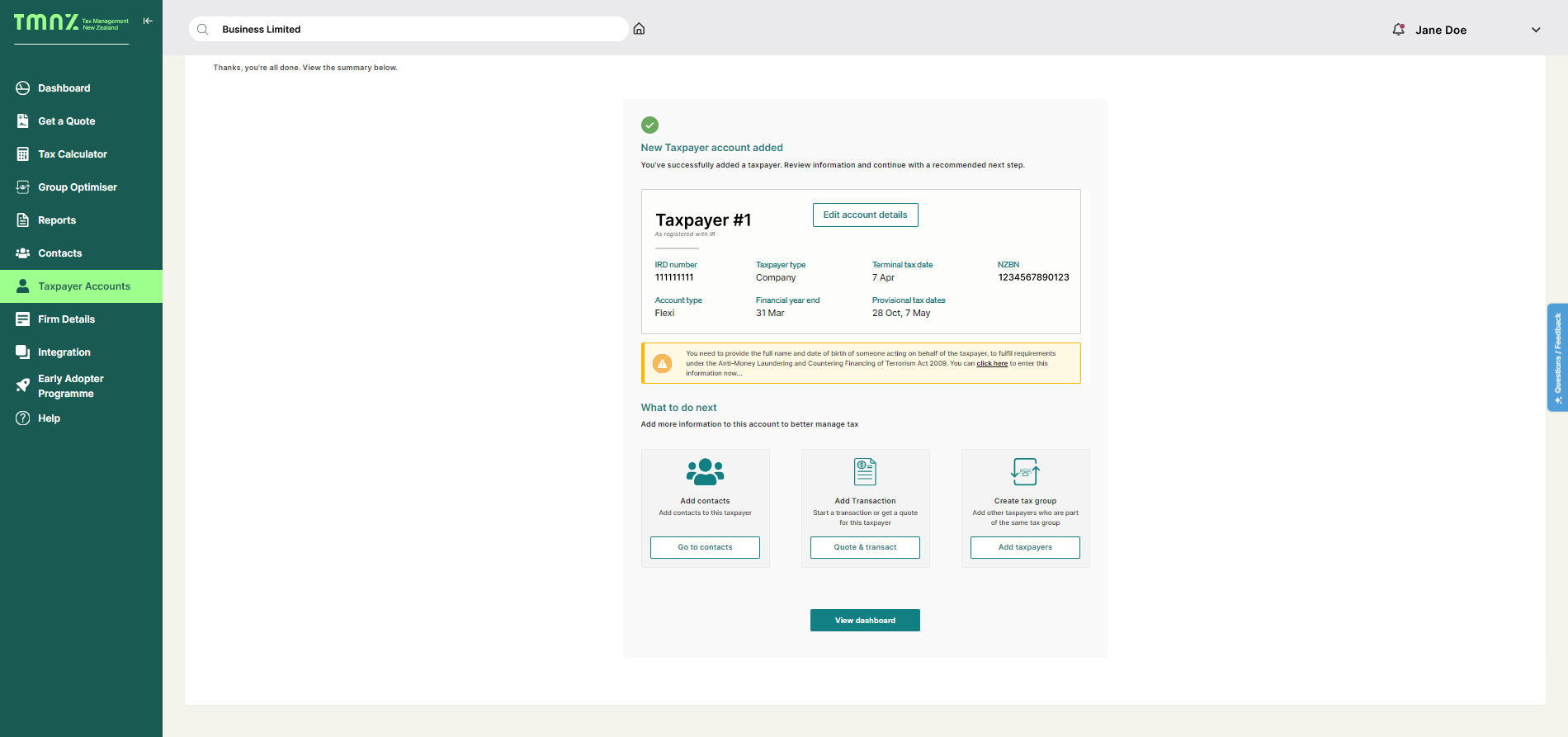

You’ve successfully added a Taxpayer account! Review information and continue with a recommended next step.

You can contact our friendly customer service team for any further support here.